Meta is launching “Meta AI” across 41 European countries, integrating its assistant into Facebook, Instagram, WhatsApp, and Messenger. Despite regulatory delays, the AI will support six languages, with group chat features rolling out soon.

Recent submarine cable cuts in the Baltic Sea have raised concerns about deliberate sabotage, affecting vital data pathways from Sweden to Lithuania and Finland to Germany. Operators emphasize the need for increased network redundancy to ensure stable connectivity.

Nokia’s recent decision to cut over 2,000 jobs in China and Europe is part of a broader strategic restructuring plan aimed at optimizing operations and realizing significant cost savings. This workforce reduction aligns with Nokia’s efforts to respond to changing global market dynamics.

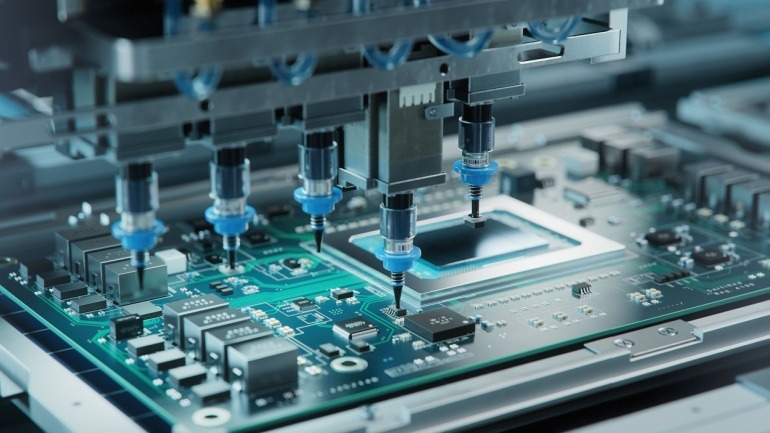

Intel has announced a significant delay in constructing new chip manufacturing facilities in Germany and Poland, following disappointing Q2 financial results. This delay could impact Europe’s ambitions to bolster semiconductor production and reduce dependence on Chinese manufacturing.

Telecom industry enthusiasts should stay updated on the latest trends and regulations, such as the groundbreaking Framework Convention on Artificial Intelligence. This AI treaty, designed by the Council of Europe, aims to align AI technologies with human rights and democracy while fostering innovation.

Iliad has ascended to one of Europe’s top five telecom operators, bolstered by a 10.3% revenue increase in H1 2024. Growing nearly 50 million subscribers across France, Italy, and Poland, Iliad’s innovative offerings, like the Freebox Ultra Wi-Fi product, and strong market performance highlight its competitiveness in the telecommunications landscape.

After more than two years of declines, the European smartphone market has started to show signs of recovery, with a 10% year-on-year increase in shipments during the first quarter of 2024, according to Counterpoint Research. However, analysts are cautious about predicting a significant long-term upswing.

Letta’s recent report underlines the fragmentation faced by the European telecoms sector, with its 27 separate national markets serving a mere average of five million customers. Highlighting the necessity for unification and increased scale for cost-effective innovation, the report aims to strengthen the sector’s competitiveness, fueling new advancements like edge computing and IoT.

In a stark warning delivered at a regional investment banking conference in Tallinn, Estonia, Ericsson CEO Börje Ekholm highlighted Europe’s precarious position in the global telecom arena. Emphasizing the urgent need for regulatory reform and innovation prioritization, Ekholm cautioned that Europe’s telecom industry is trailing far behind its counterparts in the US, China, and India.

As the new year unfolds, Vodafone has released a compelling report, underscoring the urgent need for regulatory reforms to bolster Europe’s telecommunications sector. The report, titled “Why Telecoms Matters,” paints a stark picture of the challenges Europe currently faces, emphasizing the pivotal role of mobile technology and digital transformation in overcoming these obstacles.