Vodafone’s collaboration with Salience Labs and iPronics aims to advance open radio access networks (open RAN) by harnessing the potential of silicon photonic chips. This light-based technology could promise enhanced network programmability and ultra-low latency powered by their increased speed and reduced energy consumption — elevating critical 5G capabilities. With silicon photonics making waves in data centers, the industry, poised for rapid growth, radiates intrigue on the horizon. Yet, it also questions current cost dynamics, especially around open RAN technology.

The US government has recently provided clarity regarding foreign equipment purchases under the Broadband Equity, Access and Deployment (BEAD) programme. The emphasis is on minimizing exceptions to ‘buy American’ rules, particularly reflected in the fibre-optic sector. Notwithstanding, one significant provision allows sourcing glass used in fibre optics from overseas. This comes as a relief for firms worried about supply sufficiency and costs. The spotlight of foreign vendors, meanwhile, is potentially electronics, with proposed exemptions including most semiconductors.

Reports indicate covert Huawei involvement in the establishment of chip plants to bypass US export controls. These allegations stem from Huawei’s shift to predominantly Chinese suppliers due to trade restrictions, despite their struggle to match the performance of manufacturers like TSMC and Samsung. Amidst ongoing US-China tensions, this move could potentially provoke a stronger stance from the US against sanction violators, reshaping the telecommunications landscape.

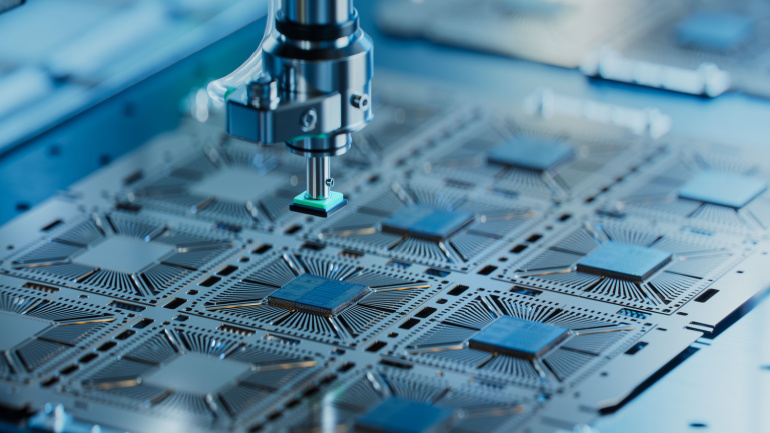

The Biden Administration’s ambitious $2 trillion infrastructure plan injects considerable capital into US chip production, with the aim of bolstering national security and reducing reliance on foreign manufacturers. Last year, the US produced only 12% of the world’s chips, highlighting a dependency on international manufacturers, primarily in Asia. Intel emerges as a key beneficiary of this investment, declaring over $43.5 billion towards manufacturing units across the US. Yet, for some companies, the journey remains fraught with caution as they await the federal funding.

In an audacious move against China’s tech supremacy, the U.S. has issued an executive order curbing American investment in several Chinese industries. Citing national security fears linked to the development of military, surveillance, and cyber technology in China, the U.S. declared a national emergency facilitating swift action. This could significantly impact sectors such as semiconductors and quantum computing, and might also influence global investment trend.

The UK’s newly established business council brings together heads of fourteen industry behemoths like AstraZeneca, NatWest Group, and Vodafone, offering insights to the Prime Minister on critical economic matters. It’s interesting that Google DeepMind is the only exception to the FTSE 100 list; also significant is the vocal Vodafone inclusion, led by CEO Margherita Della Valle, along with the impending departure of BT’s CEO Philip Jansen amidst a period of shrinkage. The absence of SME representation on the council has fueled criticism, underscoring the complexity and potential bias in shaping Britain’s economic future.

The premier Japan-EU Digital Partnership Council has unveiled a refreshingly ambitious approach towards bolstering global connectivity. Highlighting fundamental areas of mutual support, an intriguing plan of Arctic submarine network expansion piques interest. Meanwhile, an equally significant strategy promotes semiconductor industry growth, echoing an urgent call for autonomy in the global supply chain. These pacesetting initiatives promise not only to redefine EU-Japan ties, but also to spark essential digital security dialogues for the evolving tech landscape.

Huawei plans a comeback in the smartphone market with new 5G devices using domestic chip supplies. Concerns persist about the quality of these chips and Huawei’s absence from the Android Play Store. CityFibre challenges Openreach with a faster wholesale FTTH service, while Optus collaborates with SpaceX’s Starlink to expand mobile coverage in Australia’s remote areas. Ofcom investigates O2 Virgin Media over customer complaints, and the European Court of Justice rejects a ruling on the Three-O2 merger, adding to the uncertainty in the telecommunications regulatory landscape.

Taking a bold stride in data transfer innovation, the IEEE has sanctioned the 802.11bb standard, also known as LiFi. This game-changing technology uses light waves instead of radio frequencies, virtually turning an LED lightbulb into a data transmission hub. While promising high bandwidth and added security, LiFi does require line-of-sight connections, which may limit its practical applications. Industry leaders see this as more of an adjunct technology to WiFi rather than a direct competitor.

Intel’s massive €30 billion European project advances with state-of-the-art factories in Magdeburg, Germany, boosting job creation and supply chain resilience amid global semiconductor demand. Will the ambitious initiative fulfill high-tech production aspirations?