ITU platform to protect networks during Covid-19 The International Telecommunications Union (ITU) has introduced the Global Network Resiliency Platform to help global networks remain “safer, stronger and more connected” in the face of increasing strain and growing demand during the coronavirus crisis. ITU Secretary-General Houlin Zhao said, “The new platform will assist governments and the private sector in ensuring that networks are kept resilient and telecommunication services are available to all.” Also, this platform will collect relevant information and expertise on actions that telecommunication policymakers and others in the regulatory community can use to ensure that their telecom networks serve the needs of their country. Read more at https://tinyurl.com/vam4enm Remote working triggers demand for chips, laptops, and network goods As more and more employees switch to remote work during the outbreak of coronavirus disease, the demand for laptops, networking goods and supply chain components has increased substantially. Therefore, electronics retailers and…

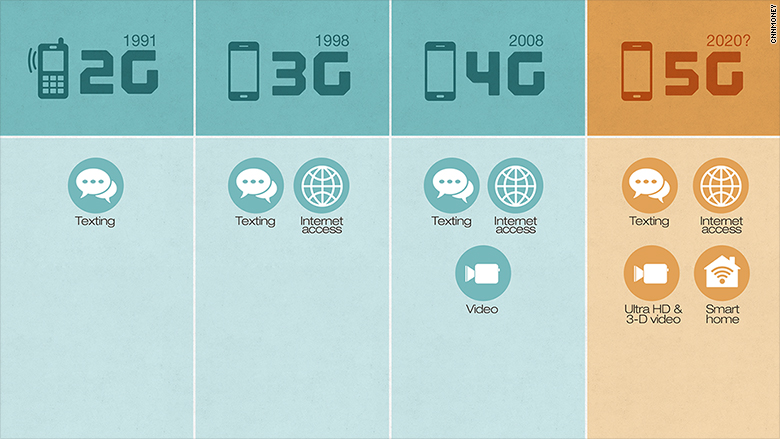

Ribbon launches Next Generation Intelligent Edge portfolio to accelerate enterprise migration to cloud services The US technology company Ribbon Communications has introduced its Next Generation Intelligent Edge portfolio that includes the new EdgeMarc 6000, the latest iteration of Ribbon’s modular platform for voice and data functions. The cloud solutions provider said that its products portfolio securely connects and enhances enterprise voice and data applications, including Microsoft Teams, while delivering service assurance, advanced analytics, security, policy and routing capabilities for cloud communications applications. Ribbon’s Next Generation Intelligent Edge portfolio delivers a comprehensive enterprise edge offering to service providers and enterprises. Read more at https://tinyurl.com/uz95gdj Early 5G smartphone market all about Samsung and Huawei According to the latest Strategy Analytics (SA) report, the demand for 5G smartphones turned out to be much higher than expected and reached 19 million units sold in 2019. Almost three-quarters of such deliveries were made by Huawei and…

British officials recommend role for China’s Huawei in 5G network UK officials have proposed allowing Chinese tech giant Huawei to play a limited role in the UK’s future 5G network, resisting calls from the US for a complete ban over fears of Chinese spying. Huawei will be kept out of the sensitive, data-heavy “core” parts of 5G infrastructure, but will be allowed to deploy its equipment in other parts of the network, according to sources speaking to Reuters. This recommendation comes ahead of a meeting of Britain’s National Security Council next week to decide how to deploy Huawei equipment. In addition, this proposal would satisfy Britain’s two largest telecoms operators, BT and Vodafone, which already use Huawei equipment and are against a total ban. Read more at: https://tinyurl.com/szmovzy CityFibre buys FibreNation from debt-laden TalkTalk for £200 million Britain’s TalkTalk Telecom Group has agreed to sell its FibreNation full-fibre network business…

Samsung’s next flagship phone chip, the Exynos 990, is 20% faster Samsung has released its new Exynos 990 flagship chipset together with the 5G-capable Exynos Modem 5123 that are expected to help the next generation of mobile devices make intensive use of video and artificial intelligence (AI) applications as well as 5G communications. The Korean electronics giant said that the Exynos 990 is 20 percent faster at executing ordinary processing tasks, 20 percent faster in graphics processing and twice as fast in software tuned for the chip’s AI acceleration scheme. Read more at: https://tinyurl.com/y2qmemq5 Nvidia and Ericsson announce the first GPU-powered 5G mobile network At this year’s Mobile World Congress in Los Angeles, California, Nvidia announced the partnership with Ericsson and Red Hat to help mobile network operators accelerate 5G deployment. The company has compared the power of its GPU-accelerated EGX hardware to traditional CPU-based servers and claims that a…

LG Uplus launches preliminary 5G roaming services in China South Korean mobile carrier LG UPlus is rolling out its 5G roaming service in China in partnership with China Unicom, a state-run telecom operator. According to the statement, LG Uplus teamed up with China Unicom for the 5G roaming service in April and tested out own services in China from June. The preliminary service was launched after the two companies completed linking their networks on August 16. LG Uplus said its 5G roaming service is currently available only on the LG V50 ThinQ smartphone, but soon it will be expanded to Samsung Galaxy S10 and Note 10 users with software upgrades. Read more at: https://tinyurl.com/yyyhqm3v Oracle strikes deal to provide cloud support for VMware workloads Oracle and VMware have announced a deal resolving their bitter dispute over how Oracle provides technical support for VMware users. The deal will make it easier…

Apple iOS 13 Launch Confirmed: 5 iPhone Security Features Coming This Month As the tech company that really cares about its user’s privacy, Apple attempts to differentiate itself from Facebook, Google and Amazon, and is bringing a number of massive improvements to the company’s iOS operating system this month. One of the biggest improvements is that the security enhanced Apple iOS 13 will not let Facebook and WhatsApp apps run VoIP in the background when the programs aren’t actively in use. Also, the system will send alerts about any apps that track user’s location and let an app access the location only once. Read more at: https://tinyurl.com/y4w8rj92 Samsung’s Exynos 980 chip is a processor and 5G modem in one The Korean tech giant has introduced its first 5G-integrated mobile chipset Exynos 980. This AI mobile processor combines a 5G modem and mobile application processor in a single chip, thus allowing…

The global race for future technologies has accelerated even further, with the South Korean wireless carrier SK Telecom announcing that it is joining forces with network hardware providers Ericsson, Nokia and Samsung Electronics to carry out collaborative research and development projects to pave the way for 6G mobile network technologies. The partnership will also help to upgrade the already-advanced 5G technology, and expand its adoption in other areas, including self-driving cars and in-built solutions. Park Jin-Hyo, Chief technology officer and Head of ICT R&D Center of SK Telecom, said, “Through strengthened cooperation with Ericsson, Nokia and Samsung Electronics, SK Telecom will be able to secure the world’s best 5G quality and lead the way towards 6G mobile network communications.” In accordance with the terms of the signed memorandums of understanding (MOUs), SK Telecom will work closely with each company to promote the advancement of 5G network technologies. They…

The 1st of January, 2019 saw the first live TV broadcast of the annual Bosingak bell-ringing New Year’s event over a 5G commercial network. SK Telecom, a South Korean wireless carrier, took advantage of the festive opportunity and offered a live, 11-minute broadcast of the country’s largest celebration in Seoul. High-definition footage on an entertainment channel XtvN showed the New Year’s countdown ceremony, the bell-ringing event and interviews. “With today’s successful live TV broadcasting over commercial 5G network, SK Telecom ushers in a new era of 5G-based media services,” said Choi Nak-hoon, Senior Vice President and Head of 5GX IoT/Data Group of SK Telecom. “In this new era, individual creators will be able to provide high-quality live broadcast anytime, anywhere, via 5G smartphones.” SK Telecom commercialised its 5G network in December 2018, accompanied by a ‘T Live Caster’ app. The solution was developed over a period of four…

The investment required to upgrade a network to support standalone 5G technology is important. JP Morgan think this is the reason why Telecom companies stocks did not do so well last year. There is a serious concern that the investment might not be as effective as expected. The lack of return put an important shade on some valuation for some asian (China, Japan and South Korea) and Australian telecommunications stocks. Those worries could be explained as the daily applications and advantages of 5G technology are yet to be seen and to be invented. James Sullivan,head of Asia ex-Japan equity research at J.P. Morgan explained “It’s not really about faster download speeds,” he said. “It’s about internet of things, autonomous vehicles and things of that nature for which no one understands a monetization case for networks yet.” 5G will not only be customer centered but also will help companies in processing…

Microsoft’s €4.3 billion investment in Italy is set to revolutionize cloud and AI infrastructure. This ambitious initiative aims to elevate Italy’s digital landscape, offering VoIP solutions that enhance connectivity and communication. By focusing on digital skills, Microsoft intends to transform Italy into a leading hub for digital innovation in the Mediterranean region.