Amazon Web Services’ upcoming European Sovereign Cloud in Germany signals a strategic shift in VoIP and cloud services, ensuring stringent data sovereignty and regional control specifically for Europe. This move aligns AWS with local data requirements, emphasizing compliance, security, and reliability—critical factors for businesses and public entities relying on cloud technology.

Twelve major European mobile operators urge regulators to allocate the upper 6GHz band for mobile use, warning that delays could hinder Europe’s 6G future. They argue the spectrum is vital for innovation and say Wi-Fi already has enough capacity, stressing the need to secure Europe’s technological edge.

Rakuten is reinforcing its European ambitions with a new tech centre in Paris, bringing together experts in AI, cloud, and platform engineering. The hub will drive innovation across its services while fostering collaboration with Rakuten France.

FCC Chairman Brendan Carr has warned EU nations about growing reliance on Starlink, highlighting risks of over-dependence on a single satellite provider. European officials share concerns, especially as geopolitical tensions rise. While local alternatives like OneWeb emerge, the EU faces tough challenges in securing technological autonomy.

Meta is launching “Meta AI” across 41 European countries, integrating its assistant into Facebook, Instagram, WhatsApp, and Messenger. Despite regulatory delays, the AI will support six languages, with group chat features rolling out soon.

Recent submarine cable cuts in the Baltic Sea have raised concerns about deliberate sabotage, affecting vital data pathways from Sweden to Lithuania and Finland to Germany. Operators emphasize the need for increased network redundancy to ensure stable connectivity.

Nokia’s recent decision to cut over 2,000 jobs in China and Europe is part of a broader strategic restructuring plan aimed at optimizing operations and realizing significant cost savings. This workforce reduction aligns with Nokia’s efforts to respond to changing global market dynamics.

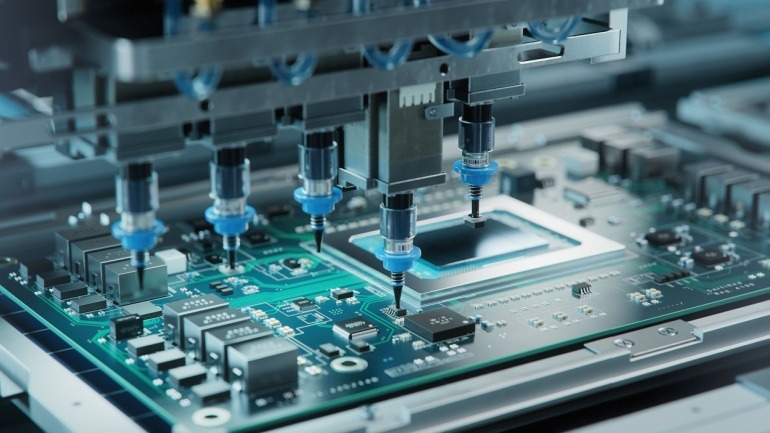

Intel has announced a significant delay in constructing new chip manufacturing facilities in Germany and Poland, following disappointing Q2 financial results. This delay could impact Europe’s ambitions to bolster semiconductor production and reduce dependence on Chinese manufacturing.

Telecom industry enthusiasts should stay updated on the latest trends and regulations, such as the groundbreaking Framework Convention on Artificial Intelligence. This AI treaty, designed by the Council of Europe, aims to align AI technologies with human rights and democracy while fostering innovation.

Iliad has ascended to one of Europe’s top five telecom operators, bolstered by a 10.3% revenue increase in H1 2024. Growing nearly 50 million subscribers across France, Italy, and Poland, Iliad’s innovative offerings, like the Freebox Ultra Wi-Fi product, and strong market performance highlight its competitiveness in the telecommunications landscape.