Ciena’s novel approach towards rising above intense market competition involves enhancing its residential fiber-to-the-home (FTTH) solutions. Their business strategy comprises strategic mergers and acquisitions, integration of unique features post acquisitions, and providing comprehensive end-to-end resolutions. Ciena’s ‘one box’ solution is highlighted for its potency on typically challenging scenarios, like rural areas, by offering reduced costs and increased flexibility. Changes are also seen from market players like VEON and Telefonica, amidst this evolving industry.

Wyre, the newly rebranded joint venture between Telenet and Fluvius, gears up for next month’s network rollout with a focus on upgrading hybrid fiber-coaxial networks to fiber-to-the-home, aiming for 78% footprint expansion in Flanders by 2038.

Deutsche Telekom has joined the German Federal Association for Fiber Optic Connections (BUGLAS), marking a significant step in fiber infrastructure promotion. This move aims to enhance nationwide fiber expansion through partnerships. However, it has sparked mixed reactions, with critics concerned it might hinder Germany’s overall fiber rollout and benefit Deutsche Telekom’s market dominance.

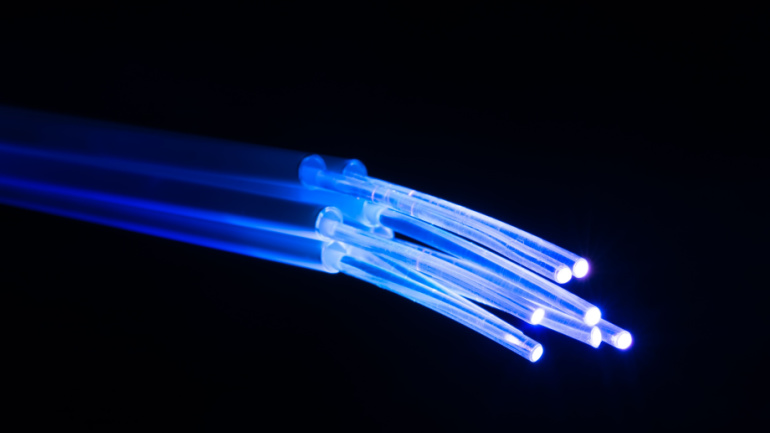

Nokia and ZCorum have developed an innovative DOCSIS Provisioning Adapter (DPA) to aid cable operators in transitioning to fiber networks. This application leverages existing DOCSIS systems while provisioning Optical Network Terminals on Passive Optical Networks. The DPA streamlines the fiber transition, enhancing scalability, performance, and reliability for cable operators.

Sitetracker and VETRO have announced a strategic partnership at Fiber Connect 2024 to streamline fiber network deployment. By integrating VETRO’s FiberMap with Sitetracker’s software, broadband providers receive enhanced geospatial data, optimizing project planning and execution.

Dutch telecommunications operator KPN has announced a partnership with pension fund ABP to form a new joint venture, temporarily named TowerCo. This entity will manage and operate 3,800 mobile towers and rooftop sites. KPN will hold a 51% stake in the venture, with ABP controlling the remaining 49%.

Italian company Tessellis has announced plans to acquire Go Internet, aiming to bolster its presence in the business services sector. The deal, initially delayed, has now met all necessary conditions and is set to proceed with Tessellis acquiring over 30% of Go Internet following a Reserved Capital Increase scheduled for the end of the month.

Nokia, in collaboration with Global Fiber Peru, has successfully launched a pioneering subaquatic optical, IP, and fiber broadband network in the Amazon rainforest. This new network aims to connect approximately 400 communities within the three-border region where Peru, Colombia, and Brazil meet.

A recent study conducted by Germany’s Verband für Telekommunikation und Mehrwertdienste (VATM) has illuminated the rapid advancements within Germany’s fiber market. The study highlights a steady stride in the country’s fiber rollout, projecting that nearly 19 million households, approximately half of the German population, will have access to fiber-to-the-premise (FTTP) connectivity by mid-year, marking a rise of 2 million households since the close of 2023.

Deutsche Telekom has emerged as the latest European telecommunications giant to report robust financial results for the first quarter of 2024. The German incumbent witnessed notable increases in revenue, earnings, and net profit, propelled by a surge in its European operations. The company’s performance underscores a positive growth trajectory amidst a competitive telecom landscape.