Diving deeper into spatial computing realms, Qualcomm releases Snapdragon XR2 Gen 2 and Snapdragon AR1 Gen 1 platforms, enhancing user immersion through improved GPU performance, AI, and concurrent camera capabilities. Snapdragon XR2 aims at efficient virtual reality navigation while AR1 offers advanced features for smart glasses. However, despite the technological leap, the mass-market embrace of AR/VR innovations stays at bay. The question remains: will Qualcomm’s efforts be enough to spur the demand boost the industry awaits?

Iliad, the French telecom operator, steps up to redefine Europe’s AI landscape, unveiling a Nvidia DGX SuperPOD, the first in Europe. Aimed for their Cloud division, Scaleway, it aims to accelerate AI services for businesses while securing a technological edge. Yet, questions on ROI and sustainability lurk amidst innovation.

The EU’s first annual State of the Digital Decade report highlights an urgent call to action for increased investment to meet its 2030 technology targets. The report underlines the significance of collective efforts by member states to successfully navigate the prevalent digital transformation. The document illuminates areas such as 5G deployment, which has been slower than expected, and inadequate fiber network coverage, among others. Simultaneously, it draws attention to other essential aspects, like digital sovereignty and the digitalization of businesses, suggesting an additional investment of at least €200 billion may be necessary. Issues such as these could hamper the bloc’s ambition to double its share in the semiconductor sector by 2030.

Nvidia aims to convince telecoms to use its GPUs in 5G networks, citing NTT Docomo’s recent GPU-accelerated 5G launch in Japan. Yet, the role of Nvidia’s GPUs in telecom remains unclear. Meanwhile, the FCC breaks a two-year deadlock, reigniting net neutrality debates. Telefonica Germany partners with Skylo for global IoT connectivity, expanding options for businesses and consumers. Nokia explores rugged 5G devices for harsh environments, catering to specialized industries with challenging conditions.

Samsung Electronics and KDDI today announced the companies have signed a Memorandum of Understanding (MOU) to form a 5G Global Network Slicing Alliance. Through this new alliance, the companies will work together to introduce an array of commercial 5G network slicing services and assess new business models based on this innovative technology.

Nokia intensifies focus on AI and machine learning enhancements with the advent of their new Open Innovation Lab in Dubai. This facility is set to target telecommunications operations in Middle East and Africa, potentially bolstering business for Dell and Hewlett Packard Enterprise. The lab’s agenda encompasses three key areas: cloud RAN collaboration, promotion of private wireless and industrial networks, and acceleration of AI-driven network automation. The lab’s existence could pave the way for increased productivity, overall network efficiency and novel revenue opportunities in the region.

Amazon’s sizable investment in one AI provider shakes up AWS’ traditional neutral stance on supporting multiple AI models—a game-changer with implications for large tech players and telecommunication operators. The recent announcement to commit up to $4 billion to Anthropic, a competitive stakeholder in AI, could alter customer experiences and sway preferences towards their Claude AI model. The telecoms industry’s reaction remains crucial as operators navigate the expanding AI revolution.

Charting the future of mobile networks, the advent of Open vRAN technology, equipped with software-defined systems on standard hardware, delivers on the ambitious goals of 5G while retaining unmatched energy efficiency. Pushing these advancements further, QCT and Intel have introduced cutting-edge servers integrating Intel’s pioneering FlexRAN architecture. This merger of CPU computing power with an accelerated system, transforming standard network structures and allowing innovative software integrations, is the driving force behind the striking efficiency improvements within mobile networks.

Prominent UK telecom companies like BT, VMO2, and Vodafone have been selected beneficiaries of government funding for research into Open RAN technology. Innovative projects, with a focus ranging from energy efficiency to security, will share in the £88 million ($121 million) funding. The main goal is to figure out whether Open RAN can rival traditional RAN, especially in high-traffic areas and rural deployments, in terms of cost, reliability and energy consumption.

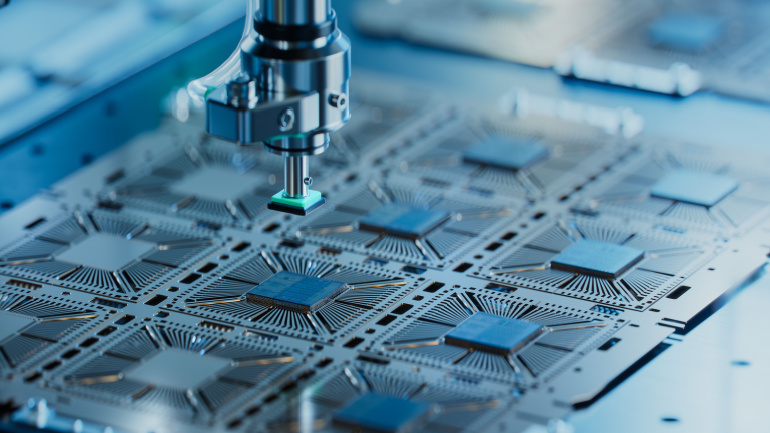

In a strategic move, Intel has decided to sell 10% of IMS Nanofabrication to Taiwan Semiconductor Manufacturing Company (TSMC), aiming to accelerate the development of cutting-edge lithography technology, vital to the production of state-of-the-art semiconductors. IMS, a leading producer of essential chip-manufacturing components, plays an essential role in the complex world of mobile devices and similar applications. The investment is expected to enhance IMS’ independence to address significant growth opportunities for multi-beam mask writing tools.