In a significant development, Intel relayed that it has agreed to divest a 10% stake in its subsidiary, IMS Nanofabrication (IMS), to Taiwan Semiconductor Manufacturing Company Limited (TSCM). This strategic maneuver demonstrates the innovative collaboration between industry giants to expedite the progression of seminal lithography technology, crucial to the formation of state-of-the-art semiconductors, so-called leading-edge nodes.

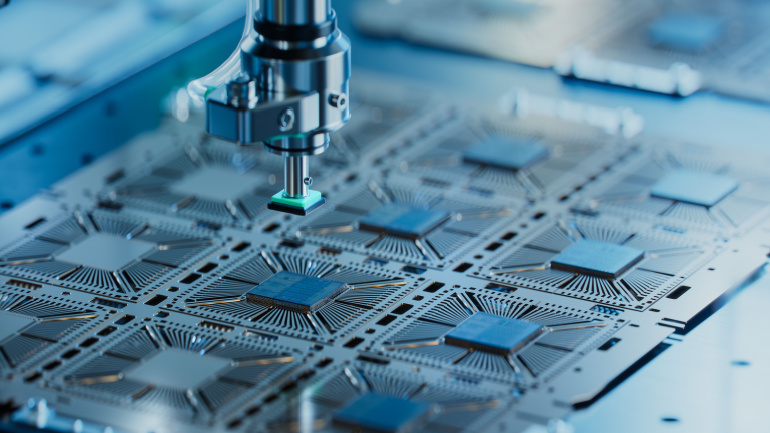

IMS, headquartered in Austria, stands at the forefront of the production of key chip-manufacturing components or ‘masks’. These integral ingredients play a pivotal role in the creation of advanced Extreme Ultraviolet Lithography (EUV), a technique critical to the fabrication of foremost semiconductors. These leading-edge nodes cater to the complex requirements of mobile devices and other similar applications.

According to estimates, the investment from TSMC elevates IMS’s value at around $4.3 billion. However, Intel is set to retain the majority stake, with the deal anticipated to come full circle by the conclusion of this year’s fourth Quarter. Matt Poirier, senior vice president of Corporate Development at Intel, asserts, “With enhanced independence, IMS will be well positioned to address the significant growth opportunity for multi-beam mask writing tools over the next decade and beyond.”

Notably, TSCM has been in business with IMS since 2012, vendoring its resources towards the development of multi-beam mask writers for refined technology nodes. Dr. Kevin Zhang, senior vice president of Business Development at TSMC, underscores that the investment is but a mere extension of their long-standing partnership purposed to bolster innovation, while also fostering more profound cross-industry collaboration.

Earlier this year, Intel transferred a 20% stake in IMS to private equity titan, Bain Capital, pegging it with the same $4.3 billion valuation. As per Reuters, this proportion of stake was worth $860 million. Such investments, from Bain Capital and TSMC alike, are designed to infuse Intel with the necessary capital to pursue its distinct foundry model and product development, all the while bolstering IMS’s independence.