Netcracker Technology has announced the extension of its long-term collaboration with Ooredoo Qatar. This partnership will see Netcracker continue to provide Managed Services for Ooredoo’s Revenue Management and CRM solutions, supporting both B2C and B2B customers. The enhanced services will cover a broad spectrum of telecom and other sectors, including ICT, IoT, and Cloud, with plans to extend into Fintech and Entertainment.

Indonesian telecom operator Indosat Ooredoo Hutchison has unveiled impressive financial results for the first quarter of 2024, alongside highlighting strategic partnerships with global tech giants Nvidia, Cisco, and Mastercard. In Q1, Indosat recorded total revenue of $873 million, marking a robust 15.8% year-on-year increase. Earnings before interest, taxes, depreciation, and amortization (EBITDA) surged by 22.1%, with an EBITDA margin of 47.0%, while net profit soared by 39.4% to reach $82 million.

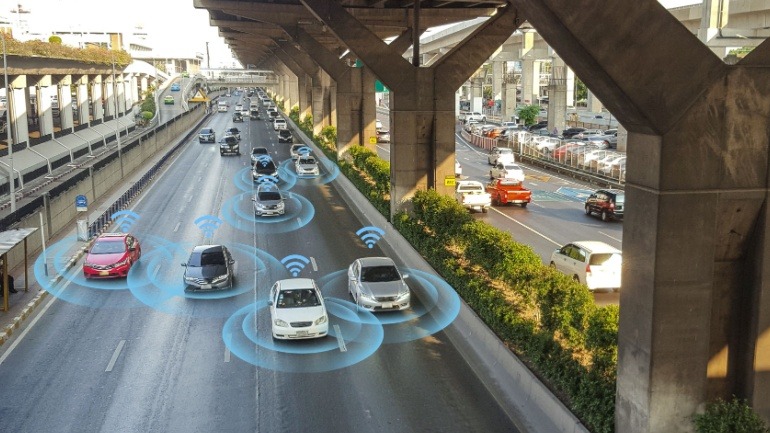

Qatar-based telecommunications giant Ooredoo has announced a strategic partnership with Nokia aimed at capitalizing on the burgeoning private 5G network sector. The collaboration, formalized through a Memorandum of Understanding (MoU), will see the two companies working together to develop bespoke 5G networks tailored for enterprise clients.

At MWC 2024, a pioneering agreement was drawn between Indosat Ooredoo Hutchison and Huawei, aiming to bolster AI’s transformative role in industry applications and skill enhancement. With AI driving industrial growth, both parties jointly commit to democratizing digitalization and nurturing shared cloud resources, fostering innovation and significant growth.

Indosat Ooredoo Hutchison (IOH) discloses plans of selling its data centres to BDx Indonesia, brightening BDx’s footprints in the Indonesian market. This move plays to the advantage of BDx who already operates data centres in Asia, while strengthening IOH’s commitment to enhance Indonesia’s tech landscape. Secured by substantial banking funding, this development emphasizes the continuous growth in the telecom and IT sectors.

In a landmark move, Zain Group, Ooredoo, and TASC Towers Holding have officially inked a definitive agreement to merge their tower assets, forming a colossal entity valued at $2.2 billion. This strategic collaboration, originating from talks initiated in July, consolidates a combined total of 30,000 towers spanning Qatar, Kuwait, Algeria, Tunisia, Iraq, and Jordan, establishing the largest tower company in the Middle East and North Africa.

Ooredoo Oman initiates a tender for its tower infrastructure sale and leaseback, inviting top telecom firms to submit bids. This follows a global trend set by major operators like Vodafone, Deutsche Telekom, and Telefonica.

Indosat Ooredoo Hutchison is leading Southeast Asia by deploying AI-RAN infrastructure in collaboration with Nokia and NVIDIA. This transformative initiative integrates Nokia’s 5G Cloud RAN solution with NVIDIA’s AI Aerial platform, revolutionizing wireless connectivity with AI-driven performance and efficiency.

Indosat partners with Xanh SM to revolutionize Indonesia’s electric vehicle sector. By integrating IoT and analytics into Xanh SM’s fleet, Indosat enhances taxi operation and customer experience.

Indosat Ooredoo Hutchison and Nokia’s partnership is set to transform Indonesia’s connectivity landscape by expanding 4G and 5G networks. This collaboration leverages Nokia’s cutting-edge radio technology to boost network coverage and quality.