LogRhythm, the company helping security teams stop breaches by turning disconnected data and signals into trustworthy insights, is holding its revamped cybersecurity summit, RhythmWorld Europe, to elevate cybersecurity collaboration. RhythmWorld Europe will bring together industry experts and professionals to share key knowledge to overcome the most pertinent modern threats. The summit returns for a second year following its successful European launch in 2023 and will take place on 30th April 2024 at CodeNode, London.

The smartphone industry is gearing up for a seismic shift as generative Artificial Intelligence (GenAI) capabilities become mainstream. According to the latest forecast from Counterpoint Research, the global shipment of GenAI-capable smartphones is expected to grow at an impressive compound annual growth rate (CAGR) of 65% between 2024 and 2027.

The UK Government’s newly established Critical Imports Council aims to lessen the disturbance of essential goods flow from unpredictable global supply chain disruptions. Business and Trade Minister, Alan Mak, highlights strengthening critical goods supply against real-world crises through collaborative efforts with industry experts. With representation from diverse sectors including telecommunications, the council will focus on assessing risks and creating robust mitigation strategies.

Bridging the digital divide in vast and harsh terrains like the Scottish Highlands, VMO2 embarks on a novel approach, utilizing a constellation of Low Earth Orbit satellites from Starlink for critical backhaul services. Bypassing conventional, costly terrestrial infrastructure, VMO2’s tests have proven the potency of satellite technology in improving coverage across the UK.

Vodafone Idea, a struggling telecom operator in India, is set to embark on a significant equity fundraising effort to secure more than $2 billion. This move comes as the company faces mounting bills and aims to finance the rollout of its 5G network.

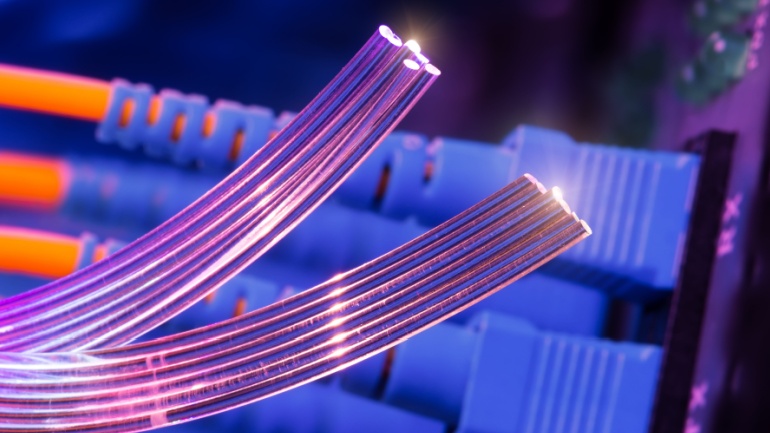

In a significant step toward enhancing the capabilities of the Large Hadron Collider (LHC), Nokia has successfully concluded an optical transmission trial in collaboration with SURF, a key player in Dutch education and research IT infrastructure. The trial achieved a breakthrough single carrier 800Gb/s optical transmission over SURF’s extensive cross-border network, which forms part of the vital research and education connectivity in Europe.

VoIP adoption offers transformative benefits, yet challenges loom. Selecting a reliable provider is paramount, demanding thorough research on reputation, features, and support. Compatibility, call quality, scalability, and network readiness necessitate meticulous planning. Security, emergency services, cost management, compliance, number portability, and employee readiness further demand attention. Successful migration hinges on strategic planning and informed decision-making.

Continuing their established partnership, Swisscom and Ericsson unveiled a multi-year agreement to boost Swisscom’s innovation and increase energy efficiency for its 5G network. The pact includes Ericsson’s Intelligent Automation Platform, facilitating advanced network management. Their united effort aims to significantly enhance user experience, while also pushing for sustainability and substantial operational savings.

In an evocative change for the telecom industry, French magnate Xavier Niel is looking to buy Datagroup-Volia, Ukraine’s top fixed telecom and pay TV provider. This big move, in the works through Niel’s NJJ company, comes complete with regulatory approval. The Ukrainian firm is a significant player, controlled primarily by a fund run by Horizon Capital.

China’s telecommunication landscape is set for a potential paradigm shift as the Ministry of Industry and Information Technology (MIIT) pilots a novel scheme to alleviate foreign ownership constraints in various value-added telecom services. Primarily trialed in Beijing, Shanghai, Hainan, and Shenzhen, this bold change could stimulate innovation by aligning these industries with global trade norms.