As the UK’s fibre landscape intensifies with rising competition, leading players are racing to expand gigabit-capable broadband nationwide. Noteworthy, alternative network providers, referred to as “AltNets”, are displaying proactive strategies to swiftly deploy networks. On the other hand, traditional companies are recognising opportunities in fibre rollout, as seen in Openreach’s pricing approach of their wholesale lines.

At the recent “5G Business Dialogue” during MWC Shanghai 2023, industry champions pondered on the positive impact of 5G adoption four years after its commercial introduction. Notably, it now makes up 10% of total revenue for China’s three providers. Furthermore, Enhanced Mobile Broadband (eMBB) services are noting considerable success due to swift user migration and industrial digitization. Innovation strides such as the Naked-eye 3D and 5G New Calling reflect the telecom sector’s future. However, with increasing Pan-Asian 5G uptake, the dialogue also ventured into the idea of “5.5G”, envisioned as a natural progression from its precursor. It’s intriguing to anticipate further transformative innovations within this industry.

Ningbo, a vibrant economic hub in China, is transforming into a smart manufacturing center, committing itself to superior digital infrastructure. The heart of this strategy encompasses a six-layered approach focused on efficient information transmission that fosters industry digitization. With established leadership in 5G industrial internet, and over 600 private networks already deployed, the city provides a gateway to the digital future. Innovation extends beyond large corporations, with solutions ranging from on-premise to lightweight 5G private networks, thus catering to businesses of all sizes. The impact is far-reaching and the future, promising, as China Mobile Ningbo aims to address industry-specific challenges with targeted 5G solutions.

Instagram’s new Threads app has garnered over 30 million sign-ups within 24 hours of its launch, along with a staggering 95 million posts and 190 million likes. While some features are missing, such as DMs and integration with ActivityPub, the impressive numbers indicate a promising start for Meta’s Twitter competitor.

Italy’s telecommunications tycoon, Retelit, ushers in a new era of growth under the leadership of newcomer CEO, Jorge Álvarez. With the recent Retelit-Irideos merger, Álvarez is set to navigate the future of this B2B market leader, backed by a solid 20-year career in the global telecom industry.

Samsung, the South Korean tech giant, has reported its lowest operating profit in 14 years for the April to June quarter. The decline is attributed to the ongoing downturn in the memory chip market. While the precise details are yet to be disclosed, analysts expect the chip division’s poor performance to be the primary cause.

Ericsson plans a €155 million investment for a smart manufacturing hub in Tallinn, Estonia. BT will reduce its workforce by 1,100 at Adastral Park while investing in modernization. Cellnex acquires full control of OnTower Poland, expanding its tower portfolio. Unicon launches an enhanced partner program for resellers in end-user computing. NEC introduces a generative AI service to drive business transformation.

Go Connect Mari is a desktop solution that enables seamless telephony integration with over 250 contact-oriented business systems and CRM applications, spanning various industries. By integrating these systems, Go Connect Mari offers significant productivity and efficiency gains for end-users.

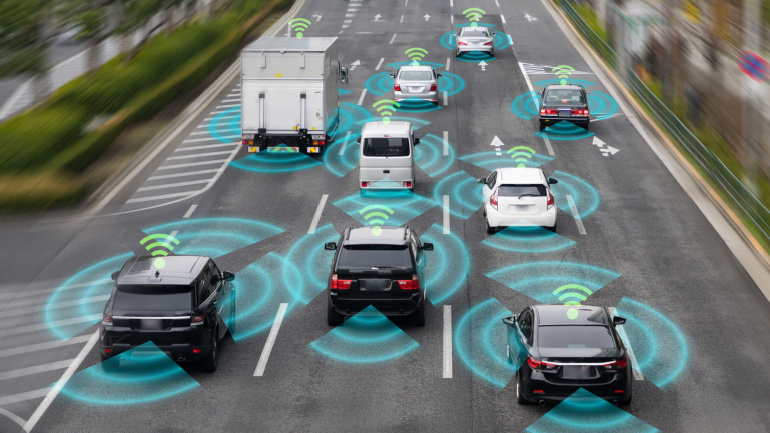

The City of Bellevue, renowned for its digital innovation, has partnered with T-Mobile to launch a collaborative project utilizing Cellular Vehicle-to-Everything (C-V2X) technology and T-Mobile’s 5G network. The initiative aims to facilitate near real-time communication between vehicles, traffic infrastructure, pedestrians, and cyclists, in support of Bellevue’s Vision Zero program, which seeks to eliminate road-related fatalities and serious injuries by 2030.

Microsoft and Salesforce have emerged as leaders in the low-code space for their integration of generative AI, according to a report by GlobalData, a prominent data and analytics company. The digital transformation era has fueled the demand for rapid app development and intelligent automation, prompting innovative enterprises to explore the potential of emerging technologies. The “Low-Code Platforms: Competitive Landscape Assessment” report by GlobalData highlights the fiercely competitive nature of the low-code market segment. Microsoft has strengthened its position by combining its Power Automate offering with the new Azure OpenAI service. On the other hand, Salesforce has been consolidating its Salesforce Flow/Automation and Einstein tools, including Einstein GPT CRM tools, within its Data Cloud platform. Charlotte Dunlap, Research Director at GlobalData, acknowledges the rapid entry of global public cloud platform providers such as Google, Microsoft, and Amazon into the low-code market. These companies are launching strategies centered around visualization tools, automation…