Travelers and businesses at Edinburgh Airport can expect notably improved 4G and 5G coverage, courtesy of telecom giant Vodafone. This upgrade not only means faster data speeds and better call quality, but could also pave the way for exciting new services such as digital passport controls and contactless check-in. Despite the complex infrastructure involved, Exchange Communications assures the ensuing benefits will outweigh the cost.

Navigating uncharted territory in the telecommunications ecosystem, Stratospheric Platforms Limited (SPL) alongside other UK giants, aims to forge advanced airborne 5G connectivity. With an ambitious endeavor backed by Britten-Norman and Marshall Futureworx, the collaborative effort seeks to birth a High-Altitude Platform with an airborne antenna – a revolution steering us to high-performing 5G from the stratosphere itself. Imagine an unmanned aircraft, fuelled by liquid hydrogen, its vast wingspan of 56 meters and lightweight structure promising flight endurance of over a week.

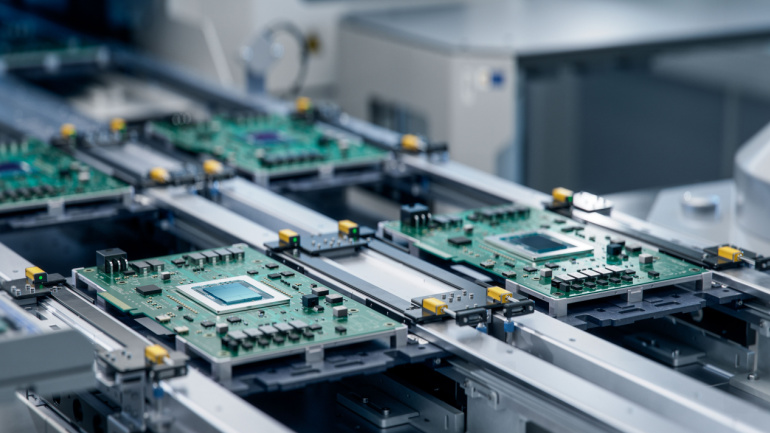

IDC predicts a promising future for the semiconductor industry, driven by AI advancements and a stock level recovery. With a refreshed outlook signaling sustainable growth, the firm anticipates global chip revenue of $526.5 billion in 2023. Progress can be seen in the revised revenue forecast for 2024, hinting at a 20.2% year-on-year growth to $633 billion.

In the ongoing debate over Big Tech’s ‘fair share’ contribution to telecom infrastructures, new findings from the Belgian Institute for Postal Services and Telecommunications call into question the validity of the argument. BIPT concludes attributing Big Tech solely for data streams might be over simplistic, citing investments made by Content Application Providers in broader infrastructures. The study raises important concerns about the potential negative impact for end-users, small local CAPs, and the principle of net neutrality.

Italian telecom provider Wind Tre faces hurdles in selling infrastructure due to complex 5G network sharing negotiations with rivals Iliad and Fastweb. CK Hutchison delays the deal closure by three months to February 12, citing challenges with Iliad and Fastweb. Meanwhile, Indosat Ooredoo Hutchison’s $6 billion merger in Indonesia with Huawei’s support achieves significant growth. France’s Orange introduces satellite broadband, while Norway’s Telenor sells its satellite operations. FCC’s new broadband rules target discrimination, raising concerns of unintended consequences. Mavenir and Nokia achieve remarkable Open RAN interoperability, overcoming past criticisms and showcasing commitment to multi-supplier systems.

The monumental $6 billion merger of Indosat Ooredoo and Hutchison 3 Indonesia has quite literally shifted the telecommunications landscape, propelling the newly formed IOH to Indonesia’s second-largest operator. Amid the complexities of combing networks, meticulous planning was key, and despite the odds, the venture has resulted in substantial improvements in service and competitive edge.

President Biden’s administration has launched an extensive review of over 2,700 megahertz of spectrum, perceiving its significant role in the nation’s technological leap. The initiative intends to implement a well-grounded American spectrum strategy, focusing on fostering tech advances, heightening public understanding about its economic role, and fostering a cooperative national framework.

Gartner forecasts a huge 20.4% increase in public cloud services expenditure by 2024, hitting an astounding $679 billion. This surge in spending could be primarily driven by business needs and innovative technologies like generative AI. Interestingly, all cloud market segments Gartner monitors are set to grow, with Infrastructure-as-a-service (IaaS) leading the pack at 26.6%. That said, as the cloud market evolves in response to business outcomes, non-technical issues such as cost, privacy, and sustainability are crucial considerations for an effective GenAI deployment.

In the face of declining shares, Vodafone’s bold recovery strategy is underway. The shift from a net profit to a loss has been attributed to several factors including missing operations, adverse foreign exchange movements, and losses from joint ventures. Nonetheless, CEO Margherita Della Valle is leading a restoration plan that includes improving customer service and expanding Vodafone Business.

After a challenging negotiation period, TPG Telecom’s endeavour to sell a range of assets to Vocus has reached an impasse. The stumbling block largely revolves around the valuation of the diverse telecom assets. TPG, however, intimates interest in reviving talks at a smaller scale, bearing interest from strategic investors in mind.