Following an infamous network outage at Optus, CEO Kelly Bayer Rosmarin chooses to resign, leaving implications of disagreement over the cause behind the outage. The issue originated from a software upgrade in the international peering network, STiX, owned by Singtel – Optus’s parent company, sparking debate on whether it culpable for the interruption.

China’s “dual carbon” mandate is reshaping data centers, creating an eco-conscious equilibrium between robust computational power and sustainability. Consider China Mobile’s Hohhot data center, built with Huawei, melding massive computational potential with cutting-edge energy-saving technologies.

In the dynamic realm of modern business, meeting customer expectations is a challenge. Unified Communications (UC) addresses this by integrating diverse communication tools into a cohesive platform. This article explores UC’s benefits, such as omnichannel experiences, personalized interactions, real-time responsiveness, enhanced collaboration, employee mobility, seamless integration with applications, and leveraging data analytics for continuous improvement. UC transforms the customer journey, fostering satisfaction, loyalty, and long-term success in the competitive business landscape.

Navigating uncharted territory in the telecommunications ecosystem, Stratospheric Platforms Limited (SPL) alongside other UK giants, aims to forge advanced airborne 5G connectivity. With an ambitious endeavor backed by Britten-Norman and Marshall Futureworx, the collaborative effort seeks to birth a High-Altitude Platform with an airborne antenna – a revolution steering us to high-performing 5G from the stratosphere itself. Imagine an unmanned aircraft, fuelled by liquid hydrogen, its vast wingspan of 56 meters and lightweight structure promising flight endurance of over a week.

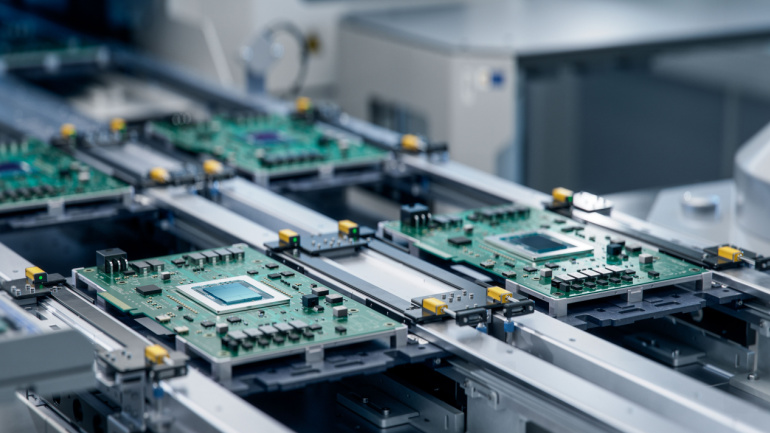

IDC predicts a promising future for the semiconductor industry, driven by AI advancements and a stock level recovery. With a refreshed outlook signaling sustainable growth, the firm anticipates global chip revenue of $526.5 billion in 2023. Progress can be seen in the revised revenue forecast for 2024, hinting at a 20.2% year-on-year growth to $633 billion.

Voice of Eutelsat’s CEO Eva Berneke for satellite connectivity competition crystalizes among customers’ cry for variety. Merging with UK’s low-Earth orbit firm, OneWeb, has catalyzed Eutelsat’s evolution as a fusion of GEO and LEO capabilities. This major leap signifies a stride in service offerings, blending Eutelsat’s superior GEO satellites with OneWeb’s timely LEO constellation, aiming for a global reach by year-end.

In the ongoing debate over Big Tech’s ‘fair share’ contribution to telecom infrastructures, new findings from the Belgian Institute for Postal Services and Telecommunications call into question the validity of the argument. BIPT concludes attributing Big Tech solely for data streams might be over simplistic, citing investments made by Content Application Providers in broader infrastructures. The study raises important concerns about the potential negative impact for end-users, small local CAPs, and the principle of net neutrality.

The Global Satellite Operators Association (GSOA) is enforcing a behavior code for satellite operators, addressing the pressing issue of space debris caused by escalating satellite broadband services. The industry aims to advance its responsibility through shared best practices to preserve space access. This action, however, fuels debate over unendorsed practices, potential impacts on astronomy, and the proposed spectrum restraint at the upcoming World Radiocommunication Conference.

The future of high-quality broadband access hinges on fiber investment, with interest spanning government, media, and network operators. Its value is in optimization, sustainability, and compatibility with the future. This technology could reshape industries, from education to smart city initiatives. The European Commission’s ambitious Digital Deco 2030, aiming to extend gigabit services to its entire populace by 2030, reflects global recognition of broadband’s potential in economic growth. Nevertheless, the disparity in gigabit-digital access remains a concern, prompting a focus on all-optical fiber networks. This reality becomes evident with Omdia’s Fiber Development Index (FDI), offering a diverse range of fiber investment metrics.

Italian telecom provider Wind Tre faces hurdles in selling infrastructure due to complex 5G network sharing negotiations with rivals Iliad and Fastweb. CK Hutchison delays the deal closure by three months to February 12, citing challenges with Iliad and Fastweb. Meanwhile, Indosat Ooredoo Hutchison’s $6 billion merger in Indonesia with Huawei’s support achieves significant growth. France’s Orange introduces satellite broadband, while Norway’s Telenor sells its satellite operations. FCC’s new broadband rules target discrimination, raising concerns of unintended consequences. Mavenir and Nokia achieve remarkable Open RAN interoperability, overcoming past criticisms and showcasing commitment to multi-supplier systems.