Saudi Arabia’s HUMAIN initiative is investing $10 billion to become a global leader in artificial intelligence. Backed by the Public Investment Fund, HUMAIN plans major data center expansion, strategic tech partnerships, and AI model training dominance by 2030, all aligning with Vision 2030.

Semtech has revolutionized fiber broadband with its new 50G PON OLT chipset, fully compliant with International Telecommunication Union standards. This innovation meets the growing bandwidth demands from applications like AI and cloud gaming.

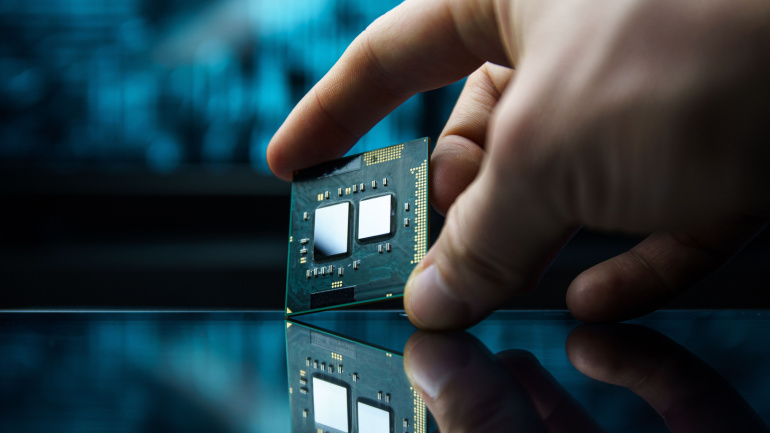

MediaTek has unveiled the Dimensity 9400, a powerful chipset built on TSMC’s 3nm process, delivering up to 40% better power efficiency and 35% faster single-core performance. Targeting edge-AI applications, it supports Wi-Fi 7, tri-fold smartphones, and advanced 5G connectivity.

Qualcomm has launched the Snapdragon 4s Gen 2, an affordable 5G chipset designed to boost its market presence. Featuring a Gigabit-capable modem but fewer high-end features, it’s aimed at budget-friendly 5G smartphones. Qualcomm’s new chip targets a growing market of cost-conscious consumers, with Xiaomi set to release the first device using the new platform.

In a recent unveiling, Qualcomm announced the introduction of the Snapdragon 8s Gen 3 chipset, poised to revolutionize a range of smartphones from brands such as Honor, iQOO, realme, Redmi, and Xiaomi in the upcoming months. This cutting-edge chip is designed to democratize premium features for a broader audience, previously exclusive to high-end models, by incorporating select advanced capabilities directly from its flagship Snapdragon 8 Gen 3 series.

In a recent announcement, chip manufacturer Qualcomm has introduced the latest iteration of its immersive technology, the Snapdragon XR2+ Gen 2. Boasting advancements in mixed reality (MR) and virtual reality (VR), the new chipset is set to power future VR innovations from tech giants Samsung and Google.

Nvidia, the graphics processing unit heavyweight, plans to enter Intel’s domain with ARM-based chips tailor-made for Windows PCs, according to insiders. AMD, another significant player in this space, is also reportedly considering ARM technology. This move, potentially hitting the market by 2025, has been stimulated by Microsoft’s interest in duplicating the efficiency of Apple’s ARM-use in AI processing. Yet, Nvidia’s past attempt to acquire ARM was thwarted by regulators, putting the company’s motives under scrutiny as the PC CPU sector braces for potential disruption.

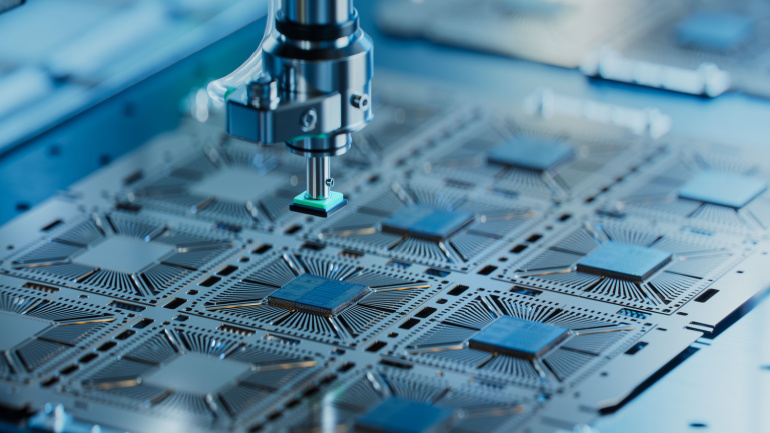

Reports indicate covert Huawei involvement in the establishment of chip plants to bypass US export controls. These allegations stem from Huawei’s shift to predominantly Chinese suppliers due to trade restrictions, despite their struggle to match the performance of manufacturers like TSMC and Samsung. Amidst ongoing US-China tensions, this move could potentially provoke a stronger stance from the US against sanction violators, reshaping the telecommunications landscape.

The Biden Administration’s ambitious $2 trillion infrastructure plan injects considerable capital into US chip production, with the aim of bolstering national security and reducing reliance on foreign manufacturers. Last year, the US produced only 12% of the world’s chips, highlighting a dependency on international manufacturers, primarily in Asia. Intel emerges as a key beneficiary of this investment, declaring over $43.5 billion towards manufacturing units across the US. Yet, for some companies, the journey remains fraught with caution as they await the federal funding.

Samsung, the South Korean tech giant, has reported its lowest operating profit in 14 years for the April to June quarter. The decline is attributed to the ongoing downturn in the memory chip market. While the precise details are yet to be disclosed, analysts expect the chip division’s poor performance to be the primary cause.