A consortium comprising two Japanese banks, mobile operator NTT DOCOMO, and Space Compass Corporation has committed $100 million to HAPS developer AALTO. This substantial investment aims to support AALTO’s industrial and commercial roadmap, targeting a commercial launch of its services by 2026.

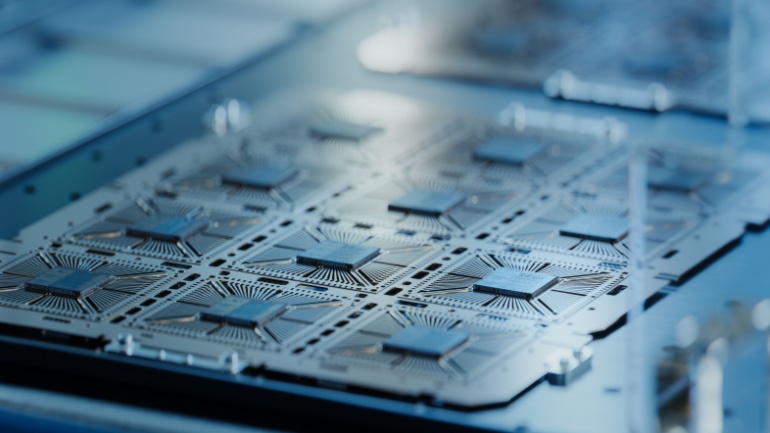

South Korea’s President Yoon Suk Yeol revealed a historic $19 billion support package aimed at bolstering the nation’s semiconductor sector, underscoring the industry’s critical role in the economy. The substantial investment, facilitated by the state-run Korea Development Bank, will enhance infrastructure, research and development, and offer tax incentives.

Ericsson has announced an additional $50 million investment in its USA 5G Smart Factory in Lewisville, Texas, adding to an initial $100 million invested in 2020. This expansion aims to increase local production to meet the rising demand for US-made 5G infrastructure, aligning with the Build America Buy America Act (BABAA).

In a significant move to bolster its presence in Europe, Amazon Web Services (AWS) has announced a substantial investment of €7.8 billion into the AWS European Sovereign Cloud project, extending through 2040. This initiative, unveiled last October, aims to establish an autonomous cloud infrastructure within the European Union (EU), operated independently to ensure data sovereignty for European customers.

In an intriguing shift, Telefónica, the Spanish telecom titan, is exploring potential profits from selling its Tech unit, stirring up future predictions. Insider details reveal engagement with multiple financial institutions and a goal to retain majority control, a factor that might affect investor incentive. Amid this, the Tech division’s impressive financial growth and its strategic significance in enterprise technology are undeniable.

The future of high-quality broadband access hinges on fiber investment, with interest spanning government, media, and network operators. Its value is in optimization, sustainability, and compatibility with the future. This technology could reshape industries, from education to smart city initiatives. The European Commission’s ambitious Digital Deco 2030, aiming to extend gigabit services to its entire populace by 2030, reflects global recognition of broadband’s potential in economic growth. Nevertheless, the disparity in gigabit-digital access remains a concern, prompting a focus on all-optical fiber networks. This reality becomes evident with Omdia’s Fiber Development Index (FDI), offering a diverse range of fiber investment metrics.

TIM enters exclusive negotiations with KKR for its network assets sale, navigating regulatory hurdles and Vivendi’s opposition. Will the deal reach a successful conclusion?

ADI invests €630 million to expand its Limerick operations, tripling fabrication capacity and fostering innovation through the €100 million ADI Catalyst Centre. Meanwhile, energy efficiency becomes a priority for 5G Massive MIMO and future 6G development.

Global telecom giant Veon commits $600 million to boost Ukraine’s infrastructure, focusing on 4G mobile and fiber development, while inviting other institutions to join the initiative. Kyivstar, Veon’s subsidiary, aims for 98% 4G coverage in three years, with potential 5G advancements.

TIM explores offers for its Enterprise business, valuing the unit at over €6 billion, while the board evaluates bids for network assets. With the company’s gross financial debt nearing €32 billion, maximizing value is crucial. KKR emerges as a frontrunner, as anticipation builds for exclusive discussions lasting until late August or early September.