South Korea’s President Yoon Suk Yeol revealed a historic $19 billion support package aimed at bolstering the nation’s semiconductor sector, underscoring the industry’s critical role in the economy. The substantial investment, facilitated by the state-run Korea Development Bank, will enhance infrastructure, research and development, and offer tax incentives.

The US government has unveiled plans this week to establish a new institute dedicated to advancing digital twin technology for the semiconductor industry. Through the CHIPS Manufacturing USA initiative, companies are invited to submit proposals to operate this institute, with the selected applicant set to receive up to $285 million in funding.

President Yoon Suk Yeol recently detailed South Korea’s aggressive moves to establish its supremacy in the global semiconductor sector, including a staggering $6.94 billion commitment to AI by 2027. Amid fierce competition, South Korea’s largest telecom firm, SK Telecom, is paralleling governmental efforts with its own investment in AI firms.

IDC predicts a promising future for the semiconductor industry, driven by AI advancements and a stock level recovery. With a refreshed outlook signaling sustainable growth, the firm anticipates global chip revenue of $526.5 billion in 2023. Progress can be seen in the revised revenue forecast for 2024, hinting at a 20.2% year-on-year growth to $633 billion.

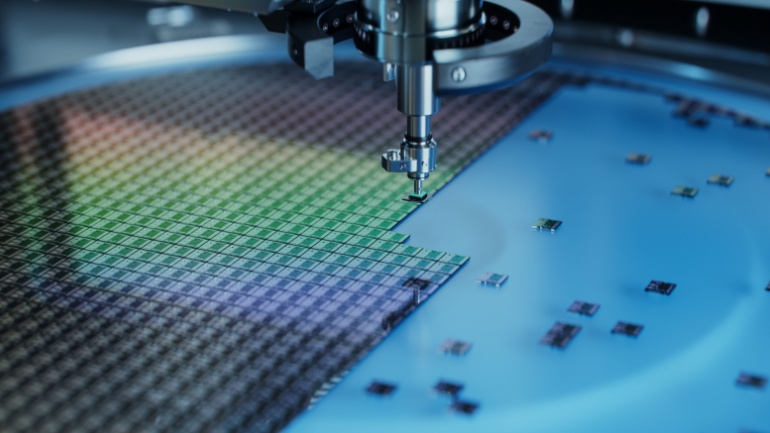

In a strategic move, Intel has decided to sell 10% of IMS Nanofabrication to Taiwan Semiconductor Manufacturing Company (TSMC), aiming to accelerate the development of cutting-edge lithography technology, vital to the production of state-of-the-art semiconductors. IMS, a leading producer of essential chip-manufacturing components, plays an essential role in the complex world of mobile devices and similar applications. The investment is expected to enhance IMS’ independence to address significant growth opportunities for multi-beam mask writing tools.

Reports indicate covert Huawei involvement in the establishment of chip plants to bypass US export controls. These allegations stem from Huawei’s shift to predominantly Chinese suppliers due to trade restrictions, despite their struggle to match the performance of manufacturers like TSMC and Samsung. Amidst ongoing US-China tensions, this move could potentially provoke a stronger stance from the US against sanction violators, reshaping the telecommunications landscape.

The US and India strengthen their strategic partnership, focusing on 6G research, Open RAN, and semiconductors, while collaborating on technology sharing, co-development, and co-production opportunities between industry, government, and academia.

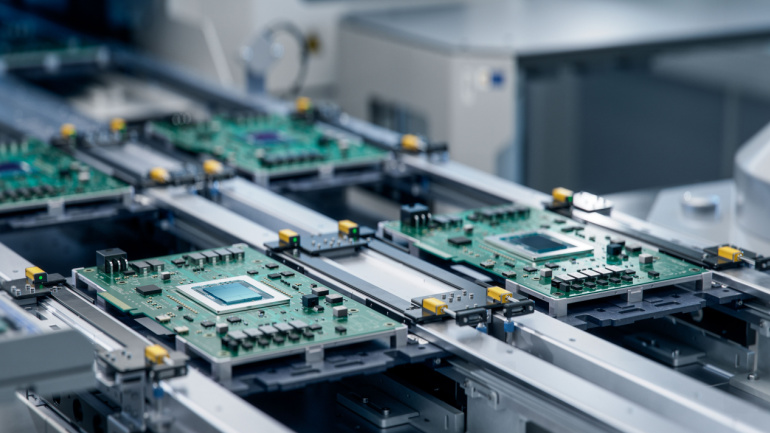

Intel’s massive €30 billion European project advances with state-of-the-art factories in Magdeburg, Germany, boosting job creation and supply chain resilience amid global semiconductor demand. Will the ambitious initiative fulfill high-tech production aspirations?

The European Commission allocates $9.2 billion for R&D initiatives in telecoms and semiconductor sectors, targeting innovative microelectronics, 5G and 6G technologies. To support digital sovereignty goals, private investment of $15.5 billion and 56 companies are involved.