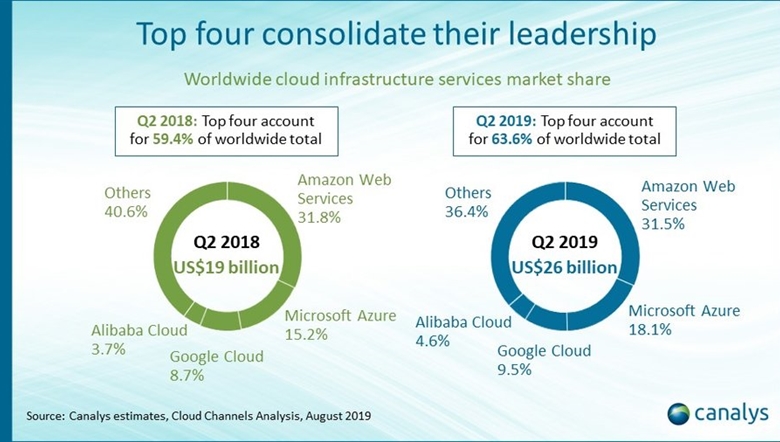

According to the most recent report from Canalys Cloud Channels Analysis, the worldwide spending on cloud infrastructure services has increased by more than one third (37.6%) year-on-year, soaring to USD 26.3 billion in the second quarter of 2019. The ranking of the leading cloud service providers remains unchanged, with Amazon Web Services (AWS) dominating at 36.1 percent growth, with revenue of over USD 8.3 billion, and a total market share of 31.5 percent.

Microsoft Azure comes second with its sales growing by 63.6 percent to just under USD 5 billion, increasing its marketing share to 18.1 percent. In third place is Google Cloud with a 9.5 percent market share, followed by Alibaba Cloud in the fourth position. In total, cloud infrastructure revenue grew by USD 7.2 billion compared to a year ago, and the current expansion marks “the biggest ever quarterly increase in terms of value, highlighting the continued robust health in cloud spending.”

Alastair Edwards, Canalys Chief Analyst, said, “In 2019, the battle for cloud migrations is set to intensify between the major cloud providers. The cloud providers’ channel strategies are increasingly important for tactical advantage and growth, particularly as more customers adopt multi-cloud.”

Pursuant to the report, Microsoft emphasized Azure migration as one of its key strategic priorities, and announced a host of new Azure incentives, focusing on partner-managed services, markets and consumption. AWS continues to recruit new partners worldwide while focusing on Windows workload migration and introducing partner initiatives aimed at ISVs and MSPs to assist in converting Windows workloads to AWS.

“Microsoft remains the leader in the cloud channel, backed by its established Cloud Solution Provider program. But recent missteps, including having to reverse unpopular changes to partner benefits, show the challenges Microsoft faces to balance cloud growth with the increased costs of serving partners. Cloud rivals that are not weighed down by legacy partner structures have an opportunity to exploit these challenges as they focus on partner recruitment,” added Edwards.

In its global channel recruitment drive, Google Cloud launched its Partner Advantage program in July and is set to stimulate Google Cloud Platform growth among enterprises in six key verticals: finance, public sector, retail, healthcare, manufacturing, and media and entertainment. In addition, last month Google teamed up with VMware to allow customers to migrate VM workloads to Google Cloud.

“Businesses are turning to partners to help them define the right clouds for different workloads, to manage and secure their complex multi-cloud environments, as well as overcome the challenges of cloud governance, cost control, compliance and integration. Without comprehensive commitments to the channel, vendors will be unable to maintain their current rapid growth rates,” said Canalys Research Analyst Daniel Liu.